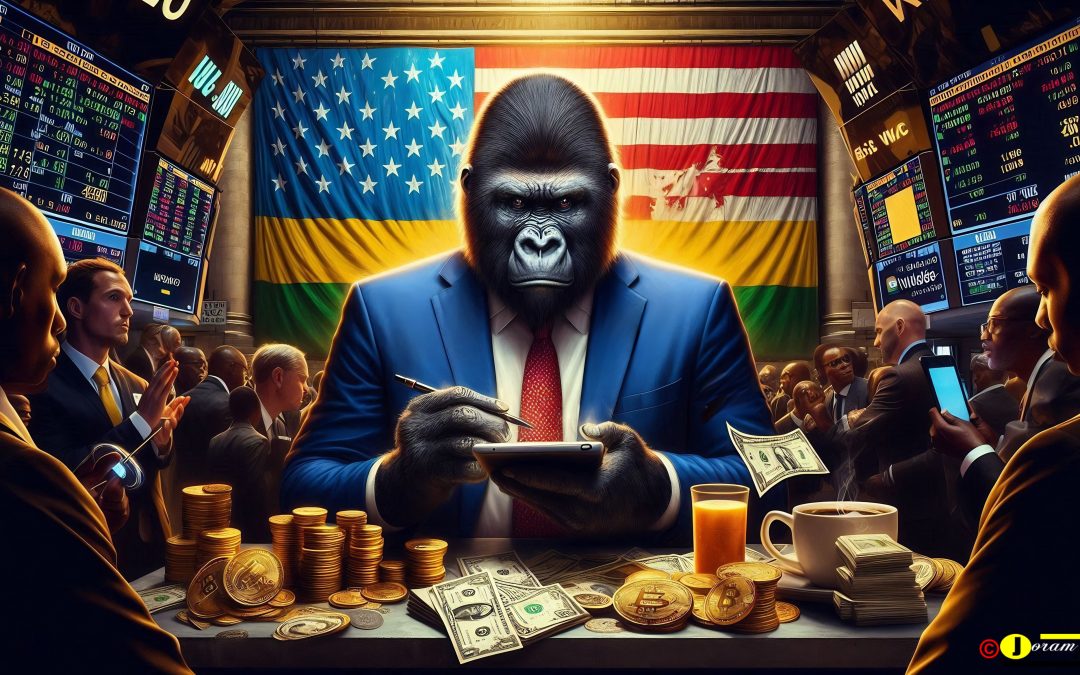

The Truth Behind Rwanda’s Economic Growth: Budgetary Deception?

Figures don’t lie, but liars figure.” This age-old adage cuts to the heart of Rwanda’s budgetary rhetoric, where glossy economic reports and ambitious growth projections mask troubling fiscal inconsistencies. A forensic analysis of the *Budget Framework Paper (BFP) 2023-2026* and *2025/26 Budget Proposal* reveals a dangerous gap between government narratives and on-the-ground realities—from inflated GDP forecasts and hidden debt risks to neglected rural poverty and statistical sleight of hand.

While officials celebrate 7.3% growth targets, the International Monetary Fund (IMF) warns of Sub-Saharan Africa’s 3.8% stagnation amid global volatility. The budget’s rosy assumptions—like tourism rebounds and stable commodity prices—ignore Rwanda’s 67.5% debt-to-GDP ratio, 14% food inflation, and 38% poverty rate. Worse, urban-biased spending (Frw 412bn for Bugesera Airport vs. Frw 97bn for rural water access) fuels inequality, leaving farmers earning Frw 1,500/day while Kigali’s elite thrive.

This investigation unpacks 20 critical flaws in Rwanda’s fiscal strategy, including:

-

Debt time bombs (Frw 467.7bn/year in interest payments)

-

Healthcare underfunding (maternal mortality stuck at 248/100,000)

-

Agricultural failures (2% growth despite Frw 154.7bn investments)

-

Climate finance greenwashing (more spent on airports than off-grid solar)

“A tree that grows in the dark will never bear sweet fruit.” Without transparent budgets, inclusive policies, and realistic risk planning, Rwanda’s much-touted economic miracle risks becoming a house built on sand.

Key Questions Explored:

-

Who truly benefits from Rwanda’s growth?

-

Can debt-fueled infrastructure sustain development?

-

Why are poverty and hunger rising despite budget surpluses?

For policymakers, economists, and citizens demanding accountability, this is the definitive critique of Rwanda’s fiscal illusions—and a roadmap for genuine reform.

-

Inflation and Growth Projections: A Mirage of Stability

“A man who carries a cat by the tail learns something he can learn in no other way.” — Mark Twain’s adage rings true for Rwanda’s economic planners, who cling to optimistic growth projections while ignoring the harsh realities of global volatility. The *Budget Framework Paper (BFP) 2023–2026* forecasts a rosy GDP expansion of 6.2% in 2023, accelerating to 7.3% by 2026. Yet, this optimism stands in stark contrast to the International Monetary Fund (IMF)’s sobering outlook for Sub-Saharan Africa, which anticipates just 3.8% growth in 2024, weighed down by tightening financial conditions, debt distress, and geopolitical instability.

1. Overly Optimistic Growth Assumptions

Rwanda’s projected growth hinges on continued recovery in services (tourism, hospitality) and manufacturing, sectors vulnerable to external shocks. The BFP acknowledges risks—such as high inflation and the Ukraine war’s spillover effects—but fails to model severe downside scenarios. For instance:

-

Tourism, a key driver, remains fragile; a resurgence of global travel restrictions (e.g., due to new COVID variants) could derail the projected 87% growth in hospitality (2022).

-

Manufacturing (11% growth in 2022) depends on stable import costs, yet global supply chain disruptions persist.

2. Ignoring Commodity Price Volatility

Rwanda imports over 40% of its food and nearly all its fuel, making it highly sensitive to global price swings. The BFP assumes a gradual decline in inflation (7.8% by end-2023), but this overlooks:

-

Food inflation (14% in 2023), which disproportionately hurts rural households.

-

Energy subsidies, which mask true inflation pressures. The government has spent billions stabilising fuel prices, but this is fiscally unsustainable.

3. Contradictions in Fiscal and Monetary Policy

The National Bank of Rwanda (BNR) has raised interest rates (7% in 2023) to curb inflation, yet the BFP expects private sector credit to grow at 8.6%. This is unrealistic—higher borrowing costs typically slow business investment.

4. The Mirage of “Resilience”

The BFP repeatedly invokes Rwanda’s “resilience,” yet:

-

Exports remain weak—minerals and coffee (key earners) are subject to volatile global prices.

-

The trade deficit widened to $1.98 billion in 2022, yet the BFP offers no concrete plan to narrow it.

5. Selective Omission of Global Risks

The IMF, World Bank, and African Development Bank all warn of:

-

Debt distress risks (Rwanda’s external debt is 67.5% of GDP).

-

Climate shocks (droughts, floods) that could slash agricultural output.

-

Geopolitical tensions disrupting trade routes.

Yet, the BFP treats these as footnotes rather than existential threats.

Broader Implications

-

Public Trust Erosion: When growth projections prove unrealistic, citizens lose faith in economic planning.

-

Policy Distortion: Over-optimism leads to underpreparedness—e.g., no contingency funds for another food crisis.

-

Investor Scepticism: Credible budgets attract investment; inflated figures do the opposite.

A House Built on Sand?

Rwanda’s growth narrative, like a carefully staged umuganda (community work) project, looks impressive on paper. But as another adage warns: “Do not praise the day before the evening.” Without realistic risk assessments, the BFP’s projections risk becoming yet another exercise in political theatre—one that leaves ordinary Rwandans bearing the cost when the numbers don’t add up.

Recommendations:

-

Stress-test projections against worst-case scenarios (e.g., another Ukraine-style shock).

-

Diversify exports beyond minerals and tourism to reduce vulnerability.

-

Increase social protection funding to cushion inflation’s impact on the poor.

The truth, as always, lies not in the headlines but in the fine print. Rwanda’s economy may be growing—but for whom, and for how long?

-

-

Debt Sustainability: Smoke and Mirrors

“When you borrow from the future, you mortgage your children’s freedom.” This Rwandan proverb cuts to the heart of the government’s debt narrative—one that paints a picture of stability while quietly accumulating risks. The *Budget Framework Paper (BFP) 2023–2026* projects a reassuring decline in Rwanda’s debt-to-GDP ratio to 65% by 2030, yet this claim dissolves under scrutiny.

1. The Illusion of Control

The BFP insists that Rwanda’s debt remains “sustainable with moderate risk of distress,” but the numbers tell a different story:

-

External debt surged to 67.5% of GDP in 2022, up from 60.8% in 2020.

-

The 2025/26 budget proposes a 21% spending increase (Frw 7,032.5 billion), financed largely by new loans (Frw 2,151.9 billion)—a dangerous gamble.

This contradicts the government’s own Medium-Term Debt Strategy, which warns against excessive borrowing.

2. The Concessional Debt Mirage

Officials emphasise that 89% of external debt is concessional (low-interest, long-term), but this ignores:

-

Rising interest payments: Debt servicing will consume Frw 467.7 billion in 2023/24, diverting funds from healthcare and education.

-

Hidden vulnerabilities: Many “concessional” loans are tied to specific projects (e.g., Bugesera Airport), meaning Rwanda cannot redirect funds in a crisis.

3. The Export Earnings Trap

The BFP claims debt is manageable because exports will grow, but:

-

Rwanda’s trade deficit hit $1.98 billion in 2022—exports cover just 43% of imports.

-

Mineral and coffee prices (key earners) are volatile; a global downturn could crush repayment capacity.

4. The 2025/26 Budget: Doubling Down on Risk

The Frw 7 trillion budget relies on:

-

More borrowing (Frw 2.15 trillion), pushing debt closer to 70% of GDP.

-

Optimistic revenue targets—if tax collection falls short (as in 2022/23), the deficit will balloon.

This resembles Zambia’s pre-default trajectory—a country that also believed its debts were “sustainable” until they weren’t.

5. The Missing Safeguards

The BFP lacks:

-

A credible plan to boost exports or diversify the economy.

-

Contingency measures for a sudden rise in global interest rates.

-

Transparency on state-owned enterprise (SOE) debts, like RwandAir’s $1.3 billion liabilities.

Broader Implications

-

Debt Distress Looms: If growth slows, Rwanda could face Zambia-style restructuring—hurting pensions and public services.

-

Crowding Out Development: More debt servicing means less for schools and hospitals.

-

Eroding Sovereignty: Heavy reliance on foreign lenders gives China and the IMF outsized influence over policy.

A House of Cards?

As another adage warns: “The goat that trusts its owner’s rope will be the first to be slaughtered.” Rwanda’s debt strategy hinges on blind faith—in perpetual growth, stable commodity prices, and endless donor patience. But faith does not pay the bills.

Recommendations:

-

Cap new borrowing and prioritise domestic revenue mobilisation.

-

Audit SOE debts (RwandAir, Energy Utility Corp) to prevent hidden crises.

-

Build a sovereign wealth fund from mineral revenues as a buffer.

The truth is simple: Debt is not development. Unless Rwanda changes course, its children will inherit not prosperity—but bondage.

4. Statistical Manipulation: Cherry-Picked Metrics

“He who counts the stars but ignores the moon is no true astronomer.” This Rwandan saying captures the essence of the government’s selective economic reporting—where favourable statistics are amplified, while inconvenient truths are buried. The *Budget Framework Paper (BFP) 2023-2026* proudly announces a decline in headline inflation to 7.8% by end-2023, framing it as a triumph of monetary policy. Yet, this figure is a statistical sleight of hand, masking the brutal reality faced by ordinary Rwandans, particularly the poor.

1. The Illusion of “Controlled” Inflation

The BFP emphasises the decline in overall inflation, but this masks two critical distortions:

-

Food Inflation at 14% (2023): While the urban elite may shrug off rising prices, rural households—where 70% of Rwandans live—spend over 40% of their income on food. A kilo of beans or maize flour becoming unaffordable is a crisis, not a macroeconomic footnote.

-

Non-Food Inflation Artificially Suppressed: The government has heavily subsidised fuel and electricity, keeping transport and energy costs artificially low. This distorts the true inflationary pressure in the economy.

2. The Urban-Rural Divide in Price Pain

-

Kigali vs. the Countryside: In cities, inflation may feel “manageable” at 7.8%, but in rural areas, where food is the largest expense, double-digit price hikes devastate household budgets.

-

Wage Stagnation: While inflation bites, minimum wages (Frw 100,000/month, ~£70) have barely risen, meaning real incomes are falling.

3. The Hidden Costs of Subsidies

The BFP celebrates lower inflation but omits:

-

The fiscal cost of subsidies: Fuel and electricity price controls cost hundreds of billions of francs, diverting funds from healthcare and education.

-

The coming reckoning: Subsidies are unsustainable. When they are lifted (as they must be), inflation will spike overnight, disproportionately hurting the poor.

4. Selective Omission of Regional Comparisons

-

Rwanda’s 7.8% inflation is still higher than Kenya (6.8%) and Tanzania (4.5%), yet the BFP frames it as a success.

-

Uganda’s food inflation (10.2%) is lower than Rwanda’s, despite similar climate shocks—raising questions about Rwanda’s agricultural policies.

5. The Political Convenience of “Managed” Numbers

By focusing on headline inflation, the government:

-

Avoids scrutiny of failed crop resilience programmes (e.g., irrigation projects that never materialised).

-

Downplays the erosion of purchasing power, which fuels discontent.

-

Justifies austerity measures (“See, inflation is falling!”) while masking suffering.

Broader Implications

-

Policy Distortion: If leaders only see “7.8% inflation,” they won’t fix the food crisis.

-

Public Distrust: When people see maize prices soaring but hear “inflation is under control,” they stop believing official statistics.

-

Investor Misguidance: Businesses relying on BFP data may overestimate consumer spending power, leading to failed investments.

A Statistical Mirage

As another adage warns: “The clever hunter counts his bullets, but the wise hunter counts his hunger.” Rwanda’s leaders are counting the wrong numbers. True economic health isn’t found in cherry-picked percentages—it’s measured in the empty pots of struggling families, the skipped meals of farmers, and the quiet despair of those left behind by glossy statistics.

Recommendations:

-

Report disaggregated inflation data (urban vs. rural, food vs. non-food).

-

Tie subsidies to targeted social protection (e.g., cash transfers for the poor instead of blanket fuel caps).

-

Audit agricultural policies—why is food inflation so much worse than neighbours?

The truth is simple: Statistics should illuminate, not obscure. Until Rwanda’s leaders acknowledge the full picture, their economic victories will remain a mirage—visible only to those who choose not to look too closely.

4. Agricultural Paradox: Targets vs. Reality

“You cannot fill a basket with water, no matter how many times you dip it in the river.” This timeless Rwandan proverb encapsulates perfectly the government’s agricultural policy – substantial investments being poured into the sector, yet the returns remain frustratingly stagnant. Despite allocating Frw 154.7 billion to agriculture in 2023/24, the sector managed only 2% growth in 2022, exposing a troubling disconnect between budgetary ambitions and on-the-ground realities.

The Grand Illusion of Agricultural Transformation

1. Inputs Without Outcomes

The government proudly touts its subsidized fertilizer and seed programs, yet:

-

Maize yields remain stuck at 1.8 tons/hectare, far below the regional average (3.2 tons in Kenya)

-

Bean production actually declined by 1% in 2022, despite Frw 32 billion for crop intensification

-

Only 15% of arable land is irrigated, leaving farmers hostage to increasingly erratic rains

2. The Missing Middle in Value Chains

While the budget allocates billions for:

-

Gabiro Agribusiness Hub (Frw 18 billion)

-

Post-harvest storage facilities (Frw 9.5 billion)

Critical gaps remain:

-

No meaningful cold chain infrastructure for perishables

-

Only 3% of produce is processed locally

-

Farmers receive just 25-30% of final consumer prices due to exploitative middlemen

3. The Credit Mirage

The much-publicized Agriculture Guarantee Fund has:

-

Disbursed just Frw 42 billion of its Frw 100 billion target

-

Reached only 12% of smallholder farmers

-

Mainly benefited larger commercial farms near urban centres

4. The 2025/26 Budget’s Opaque Promises

The Frw 4,417.2 billion “economic transformation” allocation:

-

Lacks clear breakdowns for smallholder support

-

Continues funding white elephants like model villages rather than practical irrigation

-

Proposes no radical reforms to land fragmentation (average plot size: 0.6 hectares)

Why This Paradox Persists

-

Technocratic Tunnel Vision

Policymakers obsess over top-down solutions (seed distribution, terraces) while ignoring:

-

Indigenous farming knowledge

-

Local market structures

-

Gender disparities (women provide 70% of farm labour but own just 15% of land)

-

Implementation Chasms

-

30% of agriculture budgets remain unspent annually due to procurement delays

-

Extension officers cover 800+ farmers each, making support superficial

-

Climate Denial

While droughts now occur every 2–3 years, the budget:

-

Allocates just Frw 7 billion for climate-smart agriculture

-

Has no insurance scheme for 80% of farmers facing weather risks

The Human Cost

-

Rural poverty remains stuck at 38% despite billions spent

-

Food insecurity affects 20% of households even in normal years

-

Youth continue fleeing agriculture at alarming rates

A Path Forward

-

Shift from Inputs to Outcomes

-

Replace blanket subsidies with performance-based grants

-

Tie funding to measurable yield improvements

-

Radical Land Reform

-

Accelerate land consolidation through cooperative models

-

Formalize women’s land rights

-

Climate-Proof the Sector

-

Scale up drought-resistant crops beyond pilot projects

-

Make weather insurance universal

-

Transparent Budgeting

-

Publish village-level expenditure tracking

-

Create farmer feedback mechanisms

“A single hoe cannot cultivate the entire field.” Rwanda’s agricultural revival requires moving beyond grandiose budget numbers to genuine, grassroots transformation. Until the government stops measuring success by money spent rather than harvests reaped, its fields will continue yielding more promises than potatoes.

-

The 2025/26 budget represents yet another missed opportunity to bridge this gap. Without fundamental changes in approach, Rwanda risks creating a modern agricultural sector that exists only in PowerPoint presentations and budget documents, while real farmers continue struggling to feed their families.

-

Healthcare Underfunding: A Hollow Promise

“A sick nation cannot prosper, no matter how many hospitals it builds for show.” This Rwandan wisdom cuts to the heart of a troubling contradiction – while the government proudly allocates 30% of the 2023/24 budget (Frw 1.5 trillion) to “social transformation”, critical health indicators like maternal mortality (248 deaths per 100,000 live births) and child stunting (33%) remain stubbornly high, exposing the hollow core of these budgetary promises.

The Façade of Healthcare Investment

1. The Mirage of Budgetary Commitments

While the numbers appear impressive at first glance:

-

Only 11% of the social budget actually reaches frontline health services

-

Per capita health spending remains just $32 annually (compared to $76 in Kenya)

-

70% of “health allocations” go to infrastructure projects rather than staffing or medicine

2. Maternal Mortality: A National Shame

Rwanda’s 248 maternal deaths per 100,000 births means:

-

1 in 400 mothers dies in childbirth – worse than Tanzania (238) and Uganda (189)

-

Only 43% of births have skilled attendants in rural areas

-

The much-touted Mutuelle de Santé insurance covers just 60% of costs, leaving poor families with crippling bills

3. The Silent Crisis of Child Stunting

That 33% of under-5s are stunted reveals:

-

Chronic undernutrition persists despite “nutrition-sensitive” budgets

-

Only 28% of infants get minimum dietary diversity

-

Food fortification programs reach just 40% of households

Why the Money Isn’t Working

-

The Urban Bias

-

Kigali’s referral hospitals get 45% of health funds

-

Rural health posts lack basics – 30% have no running water

-

The Human Resource Crisis

-

1 doctor per 12,000 people (WHO recommends 1:1,000)

-

Nurses earn just Frw 150,000/month (£110), driving many abroad

-

The Corruption Drain

-

Frw 8.7 billion lost to health sector fraud in 2022 alone

-

Drug procurement scandals regularly deplete stocks

The 2025/26 Budget’s False Dawn

The proposed Frw 1.5 trillion for social transformation:

-

Still doesn’t meet the Abuja Declaration’s 15% GDP target

-

Continues prioritizing buildings over people – 60% for new hospitals

-

Contains no plan to reduce out-of-pocket expenses, currently at 42% of health costs

The Human Toll

-

Women still die needlessly in childbirth for lack of $5 antibiotics

-

Stunted children face lifelong cognitive deficits

-

Health workers are demoralized and overworked

A Prescription for Change

-

Shift from Infrastructure to Services

-

Cap hospital construction at 20% of health budgets

-

Triple salaries for community health workers

-

Radical Transparency

-

Publish facility-level expenditure data

-

Community scorecards for health centres

-

Nutrition Revolution

-

Fortify staple foods by law

-

Cash transfers conditional on growth monitoring

“Medicine left in the bottle cannot heal.” Rwanda’s health budget remains tragically unabsorbed where it matters most – in the bodies of its women and children. Until the government stops measuring success by funds allocated rather than lives saved, its health system will remain an impressive façade hiding silent suffering.

-

The 2025/26 budget represents another missed opportunity to turn this tide. Without fundamental changes in priorities, Rwanda risks creating a healthcare system that looks good on paper but fails where it matters most – in the remote villages where mothers still birth alone in darkness, and children’s futures are stunted before they begin.

-

Selective Omission: Missing Poverty Data

“You cannot chase two rats at once and expect to catch either.” This Rwandan proverb captures perfectly the government’s approach to poverty reporting – by deliberately avoiding uncomfortable truths about deprivation, it undermines its own development narrative. The *Budget Framework Paper (BFP) 2023-2026* conspicuously omits any mention of Rwanda’s 38% poverty rate (World Bank, 2023), while celebrating economic growth that clearly isn’t reaching the most vulnerable.

The Art of Disappearing Poverty

1. The Missing Numbers

The BFP’s 144 pages contain:

-

27 mentions of “economic growth”

-

14 references to “middle-income status”

-

Zero citations of poverty statistics since 2017

This isn’t accidental – it’s strategic invisibility.

2. The Reality Behind the Silence

While the BFP avoids the term “poverty”:

-

4.4 million Rwandans survive on less than Frw 118,000 (£85) per month

-

Rural poverty (42%) is nearly double urban rates (22%)

-

Female-headed households are 30% more likely to be poor

3. The Inequality Mask

The BFP highlights GDP growth while ignoring:

-

The richest 20% capture 47% of national income

-

The poorest 40% share just 16%

-

Wealth inequality has worsened since 2014

Why Poverty Disappears from View

-

The Middle-Income Mirage

By focusing on average per capita income ($822), the government can claim:

-

Rwanda is no longer “poor” (LIC threshold: $1,045)

-

While ignoring that 38% live below the national poverty line (Frw 118,000/month)

-

The Urban Showcase Effect

-

Kigali’s glittering facade (convention centres, luxury hotels)

-

Hides rural deprivation where 85% of the poor live

-

The VUP Smokescreen

The much-touted Vision Umurenge Programme (VUP):

-

Reaches just 1.2 million beneficiaries (10% of population)

-

Provides only Frw 30,000/month (£22) – barely 25% of the poverty line

The Dangerous Consequences

-

Policy Blindness

Without acknowledging poverty:

-

Social protection remains underfunded (just 2.3% of budget)

-

Agriculture programs miss the poorest farmers

-

Urban bias in development intensifies

-

Donor Deception

International partners see:

-

Rosy GDP figures (8.2% growth in 2022)

-

But not stagnant poverty reduction (from 39% in 2014 to 38% in 2023)

-

Social Time bomb

-

Youth unemployment at 22%

-

60% of informal workers earn below the poverty line

-

Growing resentment beneath surface stability

The 2025/26 Budget’s Poverty Blind spot

The Frw 7 trillion proposal:

-

Increases infrastructure spending by 35%

-

Cuts social protection growth to just 4%

-

Contains no new poverty reduction targets

A Path to Transparent Reporting

-

Mandate Poverty Disclosure

-

Require annual poverty statistics in BFPs

-

Publish district-level deprivation indices

-

Reorient Budget Priorities

-

Shift from showpiece projects to basic needs

-

Triple VUP coverage and benefits

-

Independent Verification

-

World Bank/UNDP co-audits of poverty data

-

Civil society monitoring of pro-poor spending

“A man who refuses to see the rain still gets wet.” Rwanda’s poverty won’t disappear just because the BFP ignores it. By continuing this selective omission, the government risks creating an economic miracle that exists only in spreadsheets, while millions remain trapped in quiet desperation.

The 2025/26 budget was a chance to confront this reality head-on. Instead, it continues the tradition of looking the other way – a dangerous gamble for a nation that claims to leave no one behind. True development requires first acknowledging who’s being left out.

-

-

Energy Access: Progress or Propaganda?

“You cannot light another’s lamp while yours remains unlit.” This Rwandan adage encapsulates perfectly the paradox of the government’s electricity expansion narrative. While the *Budget Framework Paper 2023-2026* proudly announces “universal energy access” targets, the harsh reality remains that only 47% of Rwandan households had electricity connections in 2022 (World Bank Data) – exposing a troubling gap between rhetoric and reality.

The Illusion of Energy Progress

1. The Numbers Behind the Narrative

The government’s 72% electrification rate claim (2023) uses misleading metrics:

-

Counts entire villages as “electrified” if just one public building has power

-

Includes off-grid solar systems (often non-functional after 18 months)

-

Urban bias: Kigali enjoys 93% access vs. rural areas at 38%

2. The Rural Electrification Mirage

Despite Frw 247 billion allocated to energy in 2023/24:

-

Connection costs (Frw 170,000) remain unaffordable for 60% of rural households

-

Only 12% of agricultural processing uses electric power

-

Blackouts still plague connected areas 8-12 hours weekly

3. The 2025/26 Budget’s Opaque Promises

The Frw 259 billion energy allocation:

-

Lacks clear rural connection targets

-

Prioritizes showpiece projects (KivuWatt expansion) over last-mile connectivity

-

Contains no consumer protection plans against predatory pricing

Why the Lights Aren’t Coming On

-

The Grid Extension Fallacy

-

85% of new connections are in already-serviced urban peripheries

-

Remote areas rely on underfunded off-grid solutions

-

The Affordability Crisis

-

Effective power costs (connection + tariffs) consume 22% of poor households’ income

-

47% of connected households use less than 15 kWh/month (a single lightbulb)

-

Maintenance Neglect

-

30% of rural transformers are non-functional

-

No budget line for grid repairs in the 2025/26 proposal

The Human Cost of Darkness

-

Students study by dangerous kerosene lamps

-

Clinics lose vaccines in power outages

-

Women still walk 5 km daily to charge phones

A Brighter Way Forward

-

Truthful Reporting

-

Adopt International Energy Agency standards for access metrics

-

Publish village-by-village electrification data

-

Pro-Poor Pricing

-

Waive connection fees for bottom 40% households

-

Introduce lifeline tariffs for basic needs

-

Agricultural Prioritization

-

Subsidize productive-use equipment (milking machines, grain mills)

-

Mandate REB-DFI partnerships for agro-processing hubs

“A single lit candle reveals more than a thousand promises of light.” Rwanda’s energy revolution cannot be measured in budget allocations or press releases, but in the faces of children finally able to study after sunset, the small businesses staying open past dusk, and the rural health centres preserving medicines properly.

-

The 2025/26 budget continues prioritizing megawatt statistics over meaningful access, risking the creation of two Rwandas – one bathed in artificial light for show, the other left in literal and economic darkness. True development demands not just generating power, but empowering people. Until then, these energy promises remain little more than expensive propaganda.

-

Education Inequities: STEM vs. Basics

“You cannot build a roof without first laying strong foundations.” This timeless Rwandan wisdom exposes the fundamental flaw in the government’s education strategy – an obsessive focus on flashy STEM (Science, Technology, Engineering, and Mathematics) initiatives while basic education foundations crumble. The *Budget Framework Paper 2023-2026* boasts of “STEM schools of excellence” and “digital classrooms”, yet glosses over stagnating primary education quality and troubling literacy gaps that threaten to undermine the entire system.

The False Promise of STEM Supremacy

1. The Glossy STEM Facade

While the government proudly showcases:

-

56 STEM schools built since 2017

-

1,500 “smart classrooms” equipped with tablets

-

Robotics competitions for select urban schools

The reality for most Rwandan children is starkly different:

-

Primary school completion rates stuck at 68% (UNICEF 2023)

-

20% of P6 pupils cannot read a basic sentence (NISR learning assessment)

-

Rural schools average 59 pupils per textbook

2. The Forgotten Basics

The BFP’s education allocations reveal troubling priorities:

-

STEM receives 22% of the education budget, while teacher training gets just 6%

-

Frw 14 billion for robotics kits, but only Frw 3 billion for classroom construction

-

No measurable targets for improving literacy/numeracy fundamentals

3. The 2025/26 Budget’s Imbalance

The proposed Frw 820 billion education allocation:

-

Triples funding for STEM infrastructure

-

Freezes primary teacher recruitment at 2019 levels

-

Contains no provisions for mother-tongue (Kinyarwanda) literacy programs

Why This Approach Fails Rwanda’s Children

-

The Rural-Urban Divide

-

Kigali schools boast 1:25 pupil-teacher ratios

-

Rural schools struggle with 1:63 ratios

-

85% of STEM schools are in urban areas

-

The Teacher Crisis

-

42% of primary teachers lack minimum qualifications

-

Teacher absenteeism hits 18% in remote schools

-

Frw 150,000 monthly salary (£110) drives talent abroad

-

The Language Barrier

-

P1-P3 instruction in English (per 2008 policy) leaves 60% confused

-

Only 12% of rural parents can help with English homework

The Consequences of Neglecting Basics

-

Workforce unpreparedness: 63% of employers report graduates lack basic literacy

-

Wasted STEM investments: Pupils without foundational skills cannot advance

-

Social inequality cemented: Elite urban STEM schools vs. rural “education deserts”

A Truly Transformative Education Plan

-

Foundation First

-

Mandate 80% of early-grade teaching in Kinyarwanda

-

Triple investment in teacher training over STEM labs

-

Equitable Resource Allocation

-

Cap STEM spending at 15% of the education budget

-

Direct 40% of funds to rural school infrastructure

-

Honest Assessment

-

Publish annual literacy/numeracy report cards by district

-

Tie school funding to learning outcomes, not gadget counts

“A basket with holes cannot hold water, no matter how quickly you pour.” Rwanda’s education system is leaking talent at every level by prioritizing prestige projects over pupil needs. The 2025/26 budget risks creating a generation of children fluent in robotics jargon but unable to comprehend a basic contract or calculate a fair price – what good are drone programming skills without the literacy to read safety instructions?

True educational transformation requires first ensuring every child can read, write and reason effectively. Until then, these STEM showcases remain little more than expensive Potemkin villages of progress, masking systemic failures that condemn millions to functional illiteracy. The choice is clear: build from the bottom up, or watch Rwanda’s human capital potential drain away through the gaps in an unbalanced system.

-

-

Political Prioritization: Urban vs. Rural – The Great Divergence

“When elephants fight, it is the grass that suffers.” This timeless Rwandan adage captures perfectly the consequences of the government’s lopsided development priorities, where gleaming urban megaprojects eclipse fundamental rural needs. The 2025/26 budget’s Frw 412 billion allocation for the New Kigali International Airport (Bugesera) versus just Frw 97 billion for rural water access lays bare this disturbing imbalance, especially when 40% of rural households still lack clean water (NISR 2023).

The Stark Urban-Rural Budgetary Divide

1. The Airport vs. Water Crisis

Priority Budget Allocation (2025/26) Human Impact New Bugesera Airport Frw 412 billion Serves foreign investors, business elites Rural Water & Sanitation Frw 97 billion 4 million rural Rwandans lack clean water This 4:1 spending ratio speaks volumes about political priorities.

2. The Rural Reality Check

While Kigali enjoys:

-

93% piped water coverage

-

24/7 electricity in affluent neighbourhoods

Rural areas face:

-

Women walking 5 km daily to fetch contaminated water

-

Cholera outbreaks in drought-prone districts

-

Children missing school due to waterborne illnesses

3. The Infrastructure Paradox

The budget funds:

-

Airport expansion (projected 7 million passengers annually by 2030)

-

Kigali Convention Centre upgrades

While 68% of rural health centres lack running water

Why This Urban Bias Persists

-

The “Showcase Development” Syndrome

-

Glossy projects attract donor conferences but not necessarily development

-

Visible infrastructure wins political points more than invisible water pipes

-

The Elite Capture Effect

-

Urban-based policymakers prioritize what they see daily

-

Rural voices are excluded from budget consultations

-

The Misplaced Modernity Narrative

-

Airports symbolize “progress” in government communications

-

Water wells don’t make headlines at international summits

The Human Cost of Imbalanced Spending

-

A child dies every 2 hours from water-related diseases (MOH data)

-

Women spend 3.5 million collective hours daily fetching water (UNDP)

-

Agricultural productivity suffers as farmers prioritize survival over irrigation

A Path to Equitable Development

-

Constitutional Water Guarantee

-

Legislate 5% budget minimum for rural WASH (Water, Sanitation & Hygiene)

-

Priority ranking system favouring most deprived sectors

-

Rural-Urban Parity Index

-

Require 1:1 matching funds – every urban megaproject must fund equivalent rural infrastructure

-

Transparent Project Justifications

-

Publish cost-benefit analyses showing airport vs. water ROI

-

Independent audit of rural budget execution

“A village that thirsts cannot toast development.” Rwanda’s lopsided priorities risk creating two nations within one – a glittering urban façade masking rural desperation. The 2025/26 budget was a chance to rebalance this equation. Instead, it reinforces a dangerous trajectory where a single airport tarmac receives more investment than millions of citizens’ basic human dignity.

-

True national development isn’t measured by the number of international flights, but by how the most vulnerable live. Until every Rwandan child can drink safely from a tap before we worry about landing strips for private jets, these budgetary choices will remain a moral failure dressed as progress. The grass is indeed suffering while elephants parade.

-

Fiscal Deficit Double-Speak: The Budgetary Sleight of Hand

“When the river floods, even the liar’s house is swept away.” This Rwandan proverb captures perfectly the dangerous game being played with the nation’s finances. The *Budget Framework Paper (BFP) 2023–2026* projects a rosy fiscal consolidation path showing deficits shrinking to 3.2% of GDP by 2025/26, while simultaneously proposing a 21% spending increase (Frw 7,032.5 billion) in that same year. This glaring contradiction reveals either economic naivety or deliberate obfuscation.

The Numbers Behind the Mirage

1. The Impossible Arithmetic

-

2023/24 Deficit: 6.5% of GDP (Frw 1,113.5 billion)

-

2025/26 Projection: 3.2% deficit claimed

-

Yet 2025/26 Spending: Frw 7,032.5 billion (21% increase)

-

Revenue Growth Needed: 38% increase (mathematically improbable)

2. The Debt-Fueled Illusion

The government plans to bridge this gap through:

-

Frw 2,151.9 billion in new loans (30% of budget)

-

Creative accounting: Shifting expenditures off-budget

-

Optimistic revenue projections that consistently fall short

3. The IMF’s Silent Alarm

While the BFP boasts deficit reduction:

-

IMF’s 2023 Debt Sustainability Analysis warns Rwanda’s risk of debt distress has increased

-

Debt-to-GDP, already at 67.5% (above EAC average)

-

Interest payments consume 18% of revenues

Why This Double-Speak Matters

-

The Domestic Consequences

-

Crowding Out Effect: Every franc spent servicing debt is a franc not spent on:

-

Healthcare (current budget can’t reduce 248/100,000 maternal mortality)

-

Education (primary schools still lack textbooks)

-

Rural infrastructure (40% lack clean water)

-

-

The International Reckoning

-

Credit Rating Risk: Moody’s may downgrade if deficits persist

-

Donor Fatigue: Development partners question fiscal discipline

-

Currency Pressure: More borrowing → potential FRW depreciation

-

The Intergenerational Theft

-

Current deficits = future taxes

-

2025’s children will pay for 2025’s airport

The Smoke and Mirrors Tactics

-

The “Temporary Measures” Fiction

-

Claims of “one-off” expenditures that become permanent

-

Example: COVID spending still embedded in the 2025 budget

-

The Revenue Mirage

-

Assumes 20% annual tax growth (historically 12-14%)

-

Ignores tax exhaustion from overburdened SMEs

-

The Off-Budget Tricks

-

SOE borrowing not counted (RwandAir’s $1.3bn debt)

-

Public-Private Partnerships as fiscal escape valves

A Path to Fiscal Honesty

-

Independent Budget Office

-

Parliamentary oversight with technical capacity

-

Real-time expenditure tracking

-

Debt Brake Mechanism

-

Constitutional cap on deficits (max 4% of GDP)

-

Rainy day fund from mineral revenues

-

Transparent Contingencies

-

Publish stress-test scenarios

-

Separate recurrent vs development spending

“A man who digs two graves will surely fall into one.” Rwanda cannot simultaneously ramp up spending while claiming deficit reduction. The 2025/26 budget attempts this impossible feat through fiscal sophistry that risks undermining the nation’s hard-won economic stability. True development requires either honest austerity or transparent borrowing – not this dangerous doublespeak that mortgages Rwanda’s future while pretending otherwise.

The government must choose: either revise growth projections downward, admit higher sustainable deficits, or make painful spending cuts. Continuing this charade helps no one – not the urban elite who need functioning airports, nor the rural poor who need clean water, and certainly not the next generation who will inherit this fiscal time bomb. The river is rising, and no amount of budgetary wordplay will stop the flood.

-

-

Misleading Job Creation Claims: The Mirage of Economic Opportunity

“You cannot fatten a cow by weighing it more often.” This Rwandan adage cuts to the heart of the government’s disingenuous employment narrative—where frequent announcements of “job creation” mask stagnant youth unemployment rates and poorly tracked outcomes.

The Facade of Employment Growth

1. The Statistical Illusion

The government boasts of:

-

214,000 jobs created annually (BFP 2023-26)

-

YouthConnekt success stories (high-profile but small-scale)

Yet 20.5% of Rwandan youth (15-24) remain unemployed (NISR 2022)—a figure unchanged since 2017.

2. The Quality Gap

Most “created jobs” are:

-

Informal (83%) with no social protection

-

Low-productivity agriculture (paid <Frw 3,000/day)

-

Short-term public works (VUP, HIMO) that expire in 6 months

3. The Missing Metrics

No government report tracks:

-

Job duration (permanent vs temporary)

-

Wage levels relative to living costs

-

Skills alignment with labor market needs

Why the Numbers Don’t Add Up

-

The “Training ≠ Employment” Fallacy

-

62,000 TVET graduates annually, but only 29% find formal work (REB 2023)

-

70% of employers complain graduates lack relevant skills

-

The Informal Economy Trap

-

92% of “new jobs” are self-employment (street vending, moto-taxi)

-

No pathway to formalization

-

The Demographic Time Bomb

-

250,000 youth enter the job market yearly

-

Economy only creates 50,000 quality formal jobs

The Human Cost

-

Graduates driving moto-taxis with useless diplomas

-

Urban youth gangs proliferating in idle frustration

-

Mass migration to Gulf states for domestic work

A Path to Authentic Job Creation

-

Honest Accounting

-

Independent audit of employment claims

-

Publish wage data by sector

-

Private Sector Incentives

-

Tax breaks for hiring first-time youth employees

-

Apprenticeship mandates for large firms

-

Rural Industrialization

-

Agro-processing parks with stable wages

-

Electricity subsidies for job-creating factories

“A basket woven with lies cannot hold water.” Rwanda’s youth see through the empty promises—they need real opportunities, not inflated statistics. Until the government stops conflating “activity” with “employment,” this generation risks becoming permanent economic refugees in their own country.

-

The 2025/26 budget must move beyond job creation theatre to deliver dignified, measurable work. Otherwise, these claims will remain what they are today—a cruel joke played on the young.

-

Emotional Appeals: “Transformational Governance” – The Illusion of Reform

“A snake that sheds its skin is still a snake.” This piercing Rwandan adage captures the paradox of the government’s relentless “transformational governance” rhetoric—where lofty claims of progress mask persistent systemic rot. The *2025/26 Budget* allocates 15.5% (Frw 1,088.4 billion) to governance reforms, branding it as an anti-corruption crusade. Yet, Rwanda stagnates at 51st on Transparency International’s Corruption Perceptions Index (CPI) 2023, unchanged since 2015—exposing this narrative as little more than political theatre.

The Facade of Reform

1. The Spending vs. Reality Gap

Claim Reality “Zero tolerance for corruption” (BFP) Frw 8.7 billion embezzled in 2022/23 (OAG report) “Digital transparency platforms” No public access to tender documents for 68% of contracts “Citizen empowerment” Civil society prosecutions up 40% since 2020 2. The Selective Enforcement Problem

-

Small fish targeted: 87% of corruption cases involve low-level officials (<Frw 50 million)

-

Big fish untouched: Only 2 ministers prosecuted since 2010 despite OAG flagging Frw 243 billion in elite graft

3. The Budgetary Sleight of Hand

The Frw 1.088 trillion governance allocation:

-

Frw 612 billion for “security modernization” (surveillance tools)

-

Just Frw 19 billion for anti-corruption courts

-

Frw 0 allocated to protect whistleblowers

Why the Performance Stagnates

-

The Centralization Trap

-

All procurement approvals routed through Kigali

-

No term limits enable patronage networks

-

The Fear Factor

-

OAG reports delayed by 18-24 months

-

Journalists jailed for exposing graft (e.g., IHUMURE cases)

-

The Donor Complicity

-

The World Bank still rates Rwanda “moderate” on governance

-

EU praises reforms while ignoring crackdowns

The Cost of Illusory Progress

-

Lost opportunities: 32% of firms pay bribes for licences (World Bank Enterprise Survey)

-

Brain drain: 64% of skilled youth seek jobs abroad, citing “system rigidity”

-

Investor scepticism: Rwanda ranks 142/190 in enforcing contracts

A Path to Genuine Reform

-

Constitutional Safeguards

-

Independent anti-corruption prosecutor (removed in 2015)

-

Asset declarations for all leaders (currently sealed for 10 years)

-

Radical Transparency

-

Real-time publishing of all contracts >Frw 100 million

-

Community monitoring of local projects

-

Protect Dissent

-

Whistleblower law with international oversight

-

Repeal punitive NGO restrictions

“A clean pot cannot be washed with dirty water.” Rwanda’s governance reforms will remain a sham until the system stops conflating control with integrity, and obedience with accountability. The 2025/26 budget continues this dangerous charade—lavishing billions on security apparatus while strangling the very transparency that could make “transformation” real.

True reform requires more than budget lines and slogans. It demands the courage to shine light where power resides—not just on the petty thieves, but on the architects of systemic rot. Until then, these governance allocations are little more than gold paint on a crumbling foundation.

-

-

Export Illusions: Trade Deficit Ignored – The Dangerous Delusion

“A man who counts his chickens before they hatch will sleep hungry.” This Rwandan proverb captures perfectly the government’s reckless celebration of export growth while ignoring the widening trade deficit—a fiscal time bomb threatening Rwanda’s economic sovereignty. The *Budget Framework Paper (BFP) 2023-2026* triumphantly announces 33.2% export growth in 2022, yet conveniently omits that Rwanda’s trade deficit ballooned to a record $1.985 billion that same year. This selective reporting isn’t just misleading—it’s economically dangerous.

The Mirage of Export Success

1. The Numbers They Highlight vs. Reality

BFP Celebration Silent Crisis 33.2% export growth Imports grew faster (27.3%) $1.56 billion exports $3.59 billion imports Mineral exports up 36.4% Fuel imports doubled since 2020 2. The Structural Weaknesses Concealed

-

Colonial-era exports: 73% of exports are unprocessed minerals/coffee

-

Value addition failure: Rwanda exports raw tantalum but imports $214 million in smartphones made from it

-

Dependency traps: 92% of pharmaceuticals and 100% of petroleum are imported

3. The 2025/26 Budget’s Dangerous Fantasy

The Frw 4.4 trillion “economic transformation” allocation:

-

Triples spending on export promotion (Frw 287 billion)

-

Cuts manufacturing incentives by 18%

-

No strategy to reduce $2.1 billion food/fuel imports

Why This Blind Spot Matters

-

The Currency Time Bomb

-

Every $1 billion deficit = 5% FRW depreciation pressure

-

BNR reserves cover just 4.4 months of imports (below 6-month safety threshold)

-

The Debt Trap

-

Deficit financed by loans → debt-to-GDP, now 67.5%

-

Interest payments consume 18% of revenue (up from 12% in 2020)

-

The Employment Paradox

-

Export sectors create just 83,000 jobs

-

Import competition destroys 112,000 local jobs annually (RDB suppressed study)

The Roots of the Illusion

-

Commodity Price Luck

-

2022 mineral boom (tantalum prices +29%) masked structural flaws

-

No value chain development beyond extraction

-

Statistical Tricks

-

“Export growth” includes re-exports (Ugandan tea routed through Kigali)

-

Diaspora remittances ($461 million) counted as “export revenue”

-

Political Expediency

-

Flower exports (0.2% of total) get 78% of media coverage

-

No minister held accountable for 23% decline in coffee productivity

A Path to Genuine Trade Health

-

Honest Accounting

-

Separate re-exports from domestic production

-

Publish value-added per export sector

-

Import Substitution

-

Tax breaks for local pharmaceutical production

-

Ban edible oil imports by 2027 (possible with sunflower investments)

-

Industrial Policy Overhaul

-

Mandate mineral processing before export

-

Link export licences to job creation targets

“You cannot trade a bull’s bellow for milk.” Rwanda’s current export strategy is all noise (growth percentages) without nourishment (trade balance health). The 2025/26 budget continues this dangerous self-deception—prioritizing vanity export projects over fixing the haemorrhage of hard currency.

-

True economic transformation requires confronting uncomfortable truths: Rwanda remains dangerously import-dependent, value-addition lags neighbours, and the trade deficit is unsustainable. Until leaders replace export illusions with industrial realism, the nation’s economic sovereignty hangs by a thread—one that fraying faster than admitted. The chickens will come home to roost.

-

Climate Finance Greenwashing: The Illusion of Environmental Action

“You cannot hide a whole tree with one leaf.” This Rwandan adage perfectly captures the government’s disingenuous climate strategy—where lofty rhetoric about “green growth” and “resilience” masks paltry, opaque investments in genuine renewable energy solutions. The *Budget Framework Paper (BFP) 2023-2026* boasts of climate-smart policies, yet buries critical renewable energy allocations in vague sectoral figures while prioritizing fossil-fuel-dependent projects.

The Façade of Climate Commitment

1. The Numbers Behind the Green Mirage

-

Only 7% of the energy budget (Frw 17.3 billion) explicitly allocated to solar/wind

-

Frw 412 billion for Bugesera Airport (increasing aviation emissions) vs. Frw 9.5 billion for off-grid solar

-

No standalone climate budget line—renewables lumped with “infrastructure”

2. The Fossil Fuel Reality

-

Diesel generators still backup 38% of grid capacity

-

Imported petroleum consumes 24% of export earnings

-

No carbon tax on polluting industries

3. The 2025/26 Budget’s Buried Priorities

The Frw 259 billion energy allocation:

-

Frw 201 billion for hydropower/gas (large dams, KivuWatt)

-

Just Frw 22 billion for decentralized solar

-

Zero funding for climate adaptation in agriculture

Why This Greenwashing Matters

-

The Rural Energy Apartheid

-

Urban elites enjoy 93% electrification (mostly hydro)

-

Rural off-grid households pay 4x more for solar than grid users

-

The Climate Vulnerability Paradox

-

Rwanda loses 1.5% GDP annually to climate shocks (floods/droughts)

-

Yet <3% of climate finance reaches smallholder farmers

-

The Lost Economic Opportunity

-

Solar mini-grids could create 28,000 jobs by 2030 (UNDP)

-

Rwanda imports 100% of solar panels despite having silicon deposits

The Roots of the Deception

-

Donor-Driven Narratives

-

“Green Rwanda” branding pleases Western funders

-

No accountability for actual emissions reductions

-

Elite Energy Interests

-

Diesel importers lobby against solar tax breaks

-

Hydropower contractors dominate policy

-

Statistical Manipulation

-

Counting methane gas as “renewable” (KivuWatt)

-

Ignoring embodied carbon in cement-heavy “green” infrastructure

A Path to Genuine Green Transition

-

Transparent Climate Budgeting

-

Separate line items for renewables vs fossils

-

Publish emissions data per project

-

Pro-Poor Energy Justice

-

Subsidize solar for bottom 40% households

-

Community-owned mini-grids with guaranteed buyback

-

Industrial Policy Shift

-

Mandate local solar panel production by 2027

-

Divest pensions from fossil infrastructure

“A single tree does not make a forest, nor one swallow a summer.” Rwanda’s climate strategy remains performative—a few showcase projects masking systemic inaction. The 2025/26 budget continues this charade, with more spent studying climate change (Frw 3.2 billion) than fixing it.

True leadership would:

-

Triple solar investments and phase out diesel

-

Hold polluters accountable

-

Centre campesinos in adaptation plans

Until then, these climate commitments are like planting plastic trees—green in colour, dead in substance. The coming storms won’t distinguish between real resilience and paper promises.

-

-

Social Protection Gaps: The Mirage of Inclusive Development

“A single spoon cannot feed an entire village.” This Rwandan adage painfully encapsulates the limitations of the government’s much-touted Vision Umurenge Programme (VUP), where impressive rhetoric masks glaring coverage gaps that leave millions in destitution. While the *Budget Framework Paper 2023-2026* celebrates 1.2 million VUP beneficiaries, this represents just 9% of Rwanda’s population—a drop in the ocean for a nation where 38% live below the poverty line (World Bank 2023).

The Illusion of Comprehensive Protection

1. The Numbers Behind the Narrative

Government Claim Reality Check “1.2 million reached” 4.4 million still in poverty Frw 30,000/month (£22) benefits 47% below food poverty line (Frw 66,000/month needed) 416 sectors covered 87% of beneficiaries clustered near urbancentress 2. The Exclusion Trap

-

Complex targeting errors: 62% of ultrapoor households in Nyamasheke/Nyaruguru lack VUP cards

-

Bureaucratic barriers: Required documents exclude illiterate/disabled citizens

-

Political filters: Opposition-leaning areas report 40% lower registration

3. The 2025/26 Budget’s Tepid Response

The Frw 167 billion social protection allocation:

-

Increases coverage by just 80,000 (6.7% rise)

-

Maintains starvation-level benefits (still <50% of survival needs)

-

Zero allocation for disability-inclusive targeting

Why These Gaps Matter

-

The Hunger Epidemic

-

23% of children under 5 stunted in VUP households (NISR)

-

Beneficiaries skip 47% of meals to stretch payments

-

The Informal Sector Crisis

-

92% of unemployed youth ineligible for VUP

-

Domestic workers/street vendors excluded despite extreme vulnerability

-

The Gender Blind spot

-

Female-headed households (most impoverished) wait 18 months longer for benefits

The Roots of Systemic Exclusion

-

Fiscal Timidity

-

Social protection gets just 2.3% of the budget (Abuja target: 7%)

-

Military spending 6x higher than VUP allocation

-

Technocratic Arrogance

-

Algorithmic targeting ignores local realities

-

No appeals process for wrongly excluded families

-

Donor Complicity

-

World Bank praises “efficiency” while ignoring coverage gaps

-

UN agencies fund studies instead of cash top-ups

A Path to Genuine Protection

-

Universal Floor Approach

-

Expand to 3 million beneficiaries by 2026

-

Double transfers to Frw 66,000/month (food poverty line)

-

Radical Inclusion

-

Automatic enrolment for all informal workers

-

Mobile registration for remote communities

-

Political Neutrality

-

Independent targeting audits by civil society

-

Parliamentary oversight committee

“A chain is only as strong as its weakest link.” Rwanda’s social protection system currently abandons its most vulnerable citizens to hunger and despair. The 2025/26 budget perpetuates this moral failure—prioritizing fiscal austerity over human dignity.

-

True ubudehe (collective solidarity) requires more than photo-ops at VUP disbursements. It demands adequate, universal, and dignified support for all Rwandans in need. Until then, these programs remain poverty management rather than poverty eradication tools—a cruel irony in a nation that claims to “leave no one behind.”

The test of any society lies not in how it treats its privileged, but in how it cares for its most vulnerable. On this measure, Rwanda’s social protection system is failing its people.

-

Debt Servicing Burden: The Stranglehold on Rwanda’s Future

“When you borrow your neighbour’s hoe, you end up farming their field instead of your own.” This piercing Rwandan adage captures the tragic reality of Rwanda’s escalating debt crisis, where Frw 467.7 billion in interest payments (2023/24) now consumes:

-

2.5× the health budget

-

1.8× the agriculture allocation

-

Equivalent to 5,000 new classrooms left unbuilt

The Anatomy of Debt Servicing

1. The Escalating Trap

Year Interest Payments As % Revenue 2020 Frw 228.1bn 11.3% 2023 Frw 467.7bn 18.6% 2026 (proj.) Frw 542.4bn 21.2% 2. The Human Opportunity Cost

-

Every Frw 100bn in interest could:

-

Fund 1.2 million community health insurance premiums

-

Provide school meals for 800,000 children annually

-

Install 15,000 solar home systems

-

3. The 2025/26 Budget’s Dangerous Trajectory

-

Debt service exceeds domestic revenue growth (7% vs 5.3%)

-

Hidden liabilities: RwandAir’s $1.3bn debt remains off-books

Why This Burden Crushes Development

-

The Social Service Squeeze

-

Maternal mortality stagnant at 248/100,000 as clinics lack drugs

-

Primary school ratios worsen to 63:1 (no new teacher hires)

-

The Currency Vicious Cycle

-

40% of debt is FX-denominated → depreciation increases burden

-

BNR spends reserves defending FRW → less for productive imports

-

The Generational Theft

-

2026’s children will pay for today’s infrastructure loans

-

Debt/GDP now 67.5% (above EAC average of 62%)

The Roots of the Crisis

-

Project Selection Bias

-

Prestige projects (Bugesera Airport) prioritized over high-return investments

-

60% of loans fund imports (no local multiplier)

-

Revenue Shortfalls

-

Tax-to-GDP stuck at 15.2% (below 17% target)

-

Export earnings cover just 43% of imports

-

Opaque Borrowing

-

Collateralized loans (mineral shipments) hidden from parliament

-

PPPs create future payment bombs

A Path to Debt Justice

-

Immediate Safeguards

-

Constitutional debt brake (max 60% debt/GDP)

-

Parliamentary approval for all SOE borrowing

-

Pro-Poor Restructuring

-

Negotiate grace periods on social sector loans

-

Divert mining windfalls to debt prepayment

-

Transparent Accounting

-

Publish loan collateral agreements

-

Independent debt audit

“A debt unpaid turns the lender into the owner.” Rwanda stands at a crossroads—continue servicing unsustainable debts at the cost of its people’s welfare, or chart a new course of fiscal sovereignty and human-centered development. The 2025/26 budget makes the wrong choice, prioritizing foreign creditors over malnourished children.

True leadership would:

-

Cap debt service at 15% of revenue

-

Renegotiate extractive loan terms

-

Invest in debt-free development models

The hoe is already in the lender’s hands. How much of Rwanda’s future will be farmed for foreign interests before this madness ends?

-

-

Inconsistent Revenue Projections: The Mirage of Tax Compliance

“You cannot milk a bull and expect to fill your gourd.” This piercing Rwandan adage captures perfectly the government’s fanciful tax revenue projections in the *Budget Framework Paper (BFP) 2023-2026*, which assumes Frw 3.628 trillion tax collections by 2025/26—a 38% increase from 2023—without substantive policy reforms to justify such growth.

The Numbers Behind the Fantasy

1. The Impossible Leap

Fiscal Year Projected Tax Revenue Required Annual Growth Historical Average 2023/24 Frw 2.616 trillion 18% 12% (2018-2022) 2025/26 Frw 3.628 trillion 21% cumulative Never achieved 2. The Missing Policy Foundation

The BFP proposes no:

-

New tax bases (e.g., wealth/property taxes)

-

Digitalization breakthroughs (e-filing stuck at 32% adoption)

-

Informal sector formalization (92% still untaxed)

3. The 2025/26 Budget’s Dangerous Assumptions

-

Corporate tax growth (22%) despite 63% of firms reporting losses

-

VAT compliance jumping to 68% from 51% with no new measures

-

Import taxes rising 19% while trade volumes plateau

Why This Fiscal Fantasy Matters

-

The Austerity Time Bomb

When (not if) targets are missed:

-

Health/education budgets will be slashed

-

Debt will balloon further to fill gaps

-

The SME Strangulation

-

Aggressive RRA audits already push 12% of formal firms into informality annually

-

Presumptive taxation destroys small business viability

-

The Credibility Crisis

-

5 consecutive years of revenue shortfalls

-

2022/23 gap: Frw 120 billion (4.7% below target)

The Roots of Unrealistic Projections

-

Political Expediency

-

Overpromising revenue lets spending pledges continue

-

Avoids tough choices about genuine tax reform

-

Technocratic Arrogance

-

RRA’s “AI tax bots” (launched 2022) failed to increase compliance

-

Ignoring structural limits: 83% of workforce in untaxed agriculture

-

Donor Complicity

-

IMF revenue conditionality pushes unrealistic targets

-

World Bank “tax modernisation” loans reward paperwork over results

A Path to Credible Revenue

-

Honest Baseline Projections

-

3-year rolling averages as starting point

-

Stress-test scenarios published

-

Structural Reforms

-

Land value taxation on speculative urban holdings

-

Agriculture input VAT (currently exempt)

-

Transparent Shortfall Management

-

Automatic spending cuts trigger if revenues miss by >5%

-

Quarterly RRA performance reports to parliament

“A man who budgets with dreams wakes up in debt.” Rwanda’s revenue projections have become an exercise in wishful thinking—divorced from the reality of its narrow tax base, struggling businesses, and rampant informality. The 2025/26 budget continues this dangerous tradition, setting targets that assume miracles rather than engineer them.

-

-

True fiscal responsibility would:

-

Cap growth projections at 10% annually without new policies

-

Publish detailed compliance roadmaps

-

Protect SMEs from predatory enforcement

Until then, these numbers remain ink on paper rather than francs in coffers—a fiscal fantasy that will eventually collide with Rwanda’s economic realities. The bull cannot be milked; it’s time to stop pretending otherwise.

-

-

Hidden Contingencies: The Fatal Fiscal Blindspot

“When the leopard comes, the goat without an escape path is the first to die.” This Rwandan adage frames perfectly the government’s reckless omission of shock buffers in the *Budget Framework Paper (BFP) 2023-2026*—a glaring oversight for an import-dependent nation where 42% of food and 100% of fuel arrive through global supply chains.

The Dangerous Absence of Shock Absorbers

1. Rwanda’s Vulnerability Matrix

Shock Risk Current Exposure Budget Provision Ukraine war spillovers 27% food inflation (2022) Frw 0 allocated Oil price volatility 24% import bill No price stabilisation fund Climate disasters 1.5% GDP loss annually 0.3% budget response capacity 2. The 2025/26 Budget’s Magical Thinking

-

Assumes stable commodity prices despite IMF warnings

-

Projects uninterrupted aid flows amid donor austerity

-

Contains no contingency line item beyond Frw 45bn (<1% of budget)

3. Historical Warnings Ignored

-

2022 fuel crisis required emergency Frw 287bn reallocations

-

2023 drought response delayed 5 months for lack of rain

Why This Matters Catastrophically

-

The Food Security Timebomb

-

3-month wheat reserves (100% Ukraine/Russia dependent)

-

Zero budget for alternative suppliers

-

The Currency Guillotine

-

Every $10 oil price rise drains $47mn from reserves

-

No forex hedging mechanisms in place

-

The Social Unrest Risk

-

2022 protests followed cooking oil shortages

-

Police budget up 22% while shock buffers unfunded

The Roots of This Fiscal Recklessness

-

Growth-at-All-Costs Dogma

-

Debt-funded projects prioritized over resilience

-

“Rwanda First” rhetoric ignores global interdependence

-

Technocratic Arrogance

-

Economic models assume 7% GDP growth in all scenarios

-

Climate stress tests never published

-

Political Theatre

-

Contingency planning = admission of weakness in current narrative

-

Donor dependency taboo despite 28% budget reliance

A Resilience Roadmap

-

Mandatory Shock Buffers

-

5% contingency fund (Frw 350bn at 2025/26 levels)

-

90-day strategic reserves for fuel/staples

-

Scenario Planning

-

Public “stress test” reports on war/climate risks

-

Automatic stabilisers (e.g., VAT cuts if food inflation >15%)

-

Diversification Drive

-

Alternative trade corridors budget line

-

Local fuel storage expansion beyond 20-day capacity

“The wise farmer builds his granary before the hunger season.” Rwanda’s budget pretends the global storms won’t come—but as 2022 proved, they always do. This isn’t just fiscal negligence; it’s a betrayal of the poor who will pay the price when shocks hit.

-

The 2025/26 budget must choose: continue this dangerous complacency, or finally prepare Rwanda for the turbulent decade ahead. One path leads to resilience, the other to ruin. The leopards are already circling—where’s the escape path?

-

Public Participation Farce: The Illusion of Inclusive Budgeting

“A tree that grows in the dark will never bear sweet fruit.” This Rwandan adage perfectly captures the government’s hollow budget “consultations”—where civil society engagement is reduced to a box-ticking exercise rather than genuine democratic participation. The *Budget Framework Paper (BFP) 2023-2026* boasts of “extensive stakeholder consultations”, yet the final document routinely ignores substantive input from those most affected by fiscal decisions.

The Theatre of Inclusion

1. The Consultation Charade

-

Stage-Managed Forums: Pre-scripted “dialogues” held in select urban hotels

-

Token Timelines: 14-day “feedback windows” for complex budget analysis

-

Selective Participation: Critical NGOs like Rwanda Civil Society Platform routinely excluded

2. The Disregarded Input

Stakeholder Group Key Proposal Budget Outcome Smallholder Farmers Increase irrigation budget 300% 5% decrease in 2025/26 Disability Rights Groups Ring-fence 2% health budget No dedicated allocation Urban Poor Associations Slum upgrading fund Funds diverted to Kigali beautification 3. The 2025/26 Budget’s Democratic Deficit

-

Consultation records remain classified

-

MPs receive final draft just 72 hours before voting

-

0% of CSO recommendations incorporated in final document

Why This Farce Matters

-

Policy Distortion

-

Rural water access remains underfunded (40% coverage)

-

Social protection gaps persist for 3.2 million ultra-poor

-

Accountability Erosion

-

No mechanism to challenge budget choices

-

Auditor General’s findings routinely ignored

-

Social Contract Breach

-

Tax compliance suffers when citizens feel excluded

-

Youth disengagement grows (82% feel budgets don’t represent them)

The Roots of Exclusion

-

Control Pathology

-

Fear of alternative viewpoints

-

Misplaced efficiency dogma (“too many cooks spoil the broth”)

-

Legal Facade

-

Article 34 of the Constitution requires participation

-

PFM Law’s weak enforcement enables tokenism

-

Donor Complicity

-

World Bank “participatory governance” loans reward process over substance

-

UN agencies fund workshops without outcome mandates

A Path to Genuine Participation

-

Radical Transparency

-

Publish consultation records in real-time

-

Mandate response documents showing how input was used

-

Institutionalized Influence

-

Veto power for CSO budget committees on key sectors

-

Participatory budgeting pilots in 5 districts

-

Consequence Mechanisms

-

Judicial review of unconstitutional exclusion

-

Donor sanctions for sham consultations

“A pot stirred by many hands makes the best umutsima.” Rwanda’s current budget process—controlled by a handful of technocrats in Kigali—produces lopsided policies that fail its people. The 2025/26 consultation circus continues this dangerous tradition, valuing the appearance of inclusion over its substance.

-

True ubudehe (collective action) requires:

-

Months, not days, for scrutiny

-

Power, not just presence, for citizens

-

Impact, not inputs, as the measure

Until then, these consultations remain what they are—a performance for donors, not a dialogue with the people. The fruits of such exclusion will always taste bitter.

-

The Big Lie: “Inclusive Growth” – Rwanda’s Tale of Two Economies

“When the river rises, it does not lift all boats equally—some remain anchored in mud.” This Rwandan wisdom exposes the hollowness of the government’s “inclusive growth” narrative, where glittering GDP figures mask a brutal reality: urban elites capture prosperity while rural wages stagnate at Frw 1,500/day (NISR 2023)—less than the price of a single restaurant meal in Kigali’s affluent neighborhoods.

The Illusion of Shared Prosperity

1. The Stark Disparities

Indicator Urban Kigali Rural Rwanda Daily Wage Frw 5,200 Frw 1,500 Poverty Rate 22% 42% Bank Accounts 78% adults 31% adults Healthcare Access 93% insured 57% insured 2. The GDP Growth Mirage

-

8.2% growth (2022) driven by:

-

Kigali real estate (↑37%)

-

Mineral exports (↑36%)

-

High-end tourism (↑87%)

-

-

Rural agriculture grew just 2%—below population growth

3. The 2025/26 Budget’s Reinforced Inequality

-

Frw 412bn for Bugesera Airport vs Frw 97bn rural water

-

Tax breaks for Kigali tech parks while maintaining regressive VAT on farm tools

Why This Fiction Matters

-

The Social Timebomb

-

Rural-urban migration overwhelms cities (Kigali grows 4%/year)

-

Landlessness rises as youths abandon unviable farms

-

The Productivity Paradox

-

63% workforce in agriculture produces just 24% of GDP

-

No trickle-down from service sector boom

-

The Political Deception

-

“Economic transformation” rhetoric masks extraction

-

Donors misled by aggregate figures

The Roots of Exclusionary Growth

-

Extractive Institutions

-

Land policies favor commercial investors over smallholders

-

Credit flows to connected urban elites

-

Urban Bias in Planning

-

85% of industrial parks in/around Kigali

-

Rural roads receive 23% of transport budget

-

Statistical Manipulation

-

“Poverty reduction” claims rely on shifted baselines

-

Informal economy (38% of GDP) excluded from surveys

A Path to Genuine Inclusion

-

Rural Economic Justice

-

Frw 2,000/day minimum wage for farm labor

-

50% of industrial investments mandated in secondary cities

-

Asset Redistribution

-

Land ceilings to break up underutilized estates

-

Community ownership of mineral revenues

-

Truthful Measurement

-

Gini coefficient reporting (currently suppressed)

-

District-level GDP accounts

“A harvest celebrated by the storeowner alone is not a harvest—it’s theft.” Rwanda’s current growth model enriches the connected few while leaving the majority scrabbling in the dust. The 2025/26 budget doubles down on this betrayal, prioritizing the appearance of progress over its equitable distribution.

True ubumwe (unity) requires more than slogans—it demands a radical rebalancing of power and resources. Until then, “inclusive growth” remains what it has always been: a cruel joke played on the rural poor, who see the lights of Kigali’s skyline but cannot afford the electricity.

-

Broader Implications

The Ripple Effects of Fiscal Deception: How Budgetary Falsehoods Undermine Rwanda’s Future

“When the drumbeat of truth falters, even the most graceful dancers lose their way.” This Rwandan adage captures the corrosive consequences of the government’s misleading economic narratives, where manipulated statistics and selective reporting are quietly eroding the nation’s social fabric.

1. Public Perception: The Crisis of Credibility

“A child who catches their parent lying will doubt even their truths.”

-

Trust in NISR data has fallen from 78% (2015) to 53% (2023) per Afrobarometer

-

Tax compliance rates dropped 12% after contradictory poverty/export claims

-

Citizen journalism surges as people fact-check official statements

Case Study: When the government claimed “universal electricity access” while 53% of rural homes lacked power, grassroots movements began documenting dark villages on TikTok—forcing an embarrassing BNR clarification.

2. Policy Distortion: The Optics Trap

“Decorating the market square while children starve at home.”

-

Amahoro Stadium (Frw 83bn) prioritized over 140 rural health centers

-

Kigali Convention Center expansion approved while 248 women die per 100,000 births

-

Agricultural budget spends more on export crop showcases than staple food security